Research - (2020) Volume 9, Issue 3

Drug Life Cycle Management (LCM) includes a variety of strategies that are implemented by biotech and pharmaceutical companies to uncover the hidden value of the drug and maximize their sales and extend their commercial lives. Drug reformulation is one of the most widely used line extension strategies, which expands the therapeutic utility of drugs in different ways and provides market exclusivity. Reformulation allows pharmaceutical companies to address specific marketing needs, helps in strengthening a brand, repositioning a drug in an entirely new target population or even new therapeutic area or effectively treat patients with a specific clinical need. The motivation for a company to reformulate its brand varies according to when the reformulation is implemented during the life cycle of the drug. In this review, we present and discuss the life cycle of two new molecular entities approved by the US Food and Drug Administration during the 2001-2010 decade, aripiprazole (Trade name, Abilify) and lacosamide (Trade name, Vimpat), highlighting the reformulation strategies adopted.

Life cycle management, Reformulation, New molecular entity, Aripiprazole, Lacosamide.

ANDA: Abbreviated New Drug Application; API: Active Pharmaceutical Ingredients; ATC: Anatomical Therapeutic Chemical; AUC: Area Under Curve; Cmax:Maximum (or peak) Serum Concentration; CNS: Central Nervous System; EU: European Union; IC50: Half Maximal Inhibitory Concentration; Ki: Inhibitory Concentration; LCM: Life Cycle Management; μM: Micromolar; mg: milligrams; mg/ml: milligrams per millilitre; NDA: New Drug Application; NME: New Molecular Entity; nM: Nanomolar; ROA: Route of Administration; ROI: Return on Investment; USFDA: United States Food and Drug Administration

Bringing a new drug from invention to the pharmacy takes on an average $2.7 billion at a 90% failure rate in clinical trials and the process takes 10-15 years [1,2]. This is aptly reflected in the words of James Black, one of the winners of the 1988 Noble Prize in Medicine, who opines that “Trying to invent new drugs is no picnic.” The commercial goal of drug developers is to make profit from a drug to recoup the R and D investment cost of that drug as well as to cover the costs from other products in their portfolio which may have failed during development and never reached the market. Each drug has its own unique product life cycle beginning from its birth as an invention through its clinical testing in human subjects to granting marketing authorization by the regulatory agency. Post-approval, market launch of the drug generates sales revenues until the expiration of 20-year patent term or the loss of exclusivity. The loss of 20-year patent term is one of the major factors in the rapid loss of drug sales. This period, called as “patent cliff” also marks the entry of the generic copies of the originator drugs. Competition among generic drugs restrains drug prices [3]. Challenges faced by originator and generic drug companies create opportunities to drive innovation through suitable LCM strategies [2].

Life cycle management (LCM) of a drug is the process of managing drug life cycle through fully realizing the commercial and clinical value, right from the initial developmental stages to the eventual retirement from the market [4]. Pharmaceutical and biopharmaceutical companies regularly employ LCM strategies to maximize the return on investment (ROI) from a drug, which has been successfully launched into the market. The top LCM strategies adopted by pharmaceutical companies are: New therapeutic uses of the existing drug through drug repurposing and new products based upon certain changes in the original drug through reformulation [5,6].

Various chemical entities that are combined to form a drug constitute the formulation of the drug. These entities include the active pharmaceutical ingredients (APIs) that impart a drug with its therapeutic properties as well as the excipients that stabilize the drug, impart bulk and aid in the optimization of drug administration, absorption etc. The most significant challenges and considerations faced by pharma companies when developing a drug formulation are safety, appropriate therapeutic and delivery profiles, and bioavailability issues [7]. Reformulated products of the original drugs address these challenges through achieving improved drug delivery, optimum therapeutic effect and improved patient compliance. It enables the widening of the drug’s scope to include new indications, patient populations, routes of administration (ROA) and dosages [2].

In this article, we have performed a systematic analysis of two new molecular entities (NMEs), from CNS therapeutic area, approved by the US Food and Drug Administration (USFDA); aripiprazole (2002) and lacosamide (2008), and follow their life cycle since their first approval with a focus on reformulation strategy adopted by the originator drug companies for patient care and commercial benefit. Through these case studies, we will discuss the impact of reformulation on market access, revenue generation, new indications and patient populations.

Here, we will focus on reformulation as an LCM strategy and understand its impact on market access, revenue generation, new indications and subpopulations of patients through an analysis of the life cycle of two drugs: Aripiprazole and Lacosamide.

Identification of NMEs approved within 2001-2010

FDA-approved NMEs and their respective APIs between 2001- 2010 were identified from the FDA Orange book. To ensure that the identified APIs have not been approved prior to 2001, NME list from 2001-2010 was compared with the one prior to 2001. Drug details for the first approval were captured from Orange book. These details included the names of APIs, trade names, application numbers, dosage forms, route of administration, strength and approval dates were captured from Orange book. Anatomical Therapeutic Chemical (ATC) codes, which divide the drugs based upon organs and systems, were acquired from https://www.whocc.no/atc_ddd_index

Ranking of the NMEs with a focus on reformulation

Using the FDA orange book, data regarding the dosage forms and routes of administration of each of the enlisted NMEs was procured. NMEs approved between 2001-2010 for central nervous system (CNS) diseases were considered for further selection. A total of 30 NMEs were approved in this time period for CNS diseases. The NMEs were ranked based on the number of dosage forms as well as routes of administration. It was observed that the anti-schizophrenia drug aripiprazole (sold as Abilify by Otsuka Pharmaceuticals and Bristol-Myers-Squibb) and the antiepileptic drug lacosamide (sold as Vimpat by UCB Inc.) ranked as top two NMEs. We, therefore shortlisted these two NMEs for further analysis. All drug products (all NDAs and all ANDAs) were captured for these two drugs.

Reformulation success story for abilify (aripiprazole)

Abilify, a brand name for aripiprazole, is the first in a new class of atypical anti-psychotics. It was invented by Otsuka Pharmaceutical as OPC-14597 [8]. Abilify was co-developed and co-promoted along with Bristol-Myers-Squibb (BMS) for schizophrenia and several other brain related disorders. Abilify has high affinity for dopamine D2 and D3, serotonin 5-HT1A and 5-HT2A receptors (Ki values of 0.34 nM, 0.8 nM, 1.7 nM, and 3.4 nM, respectively), moderate affinity for dopamine D4, serotonin 5-HT2C and 5-HT7, alpha1-adrenergic and histamine H1 receptors (Ki values of 44 nM, 15 nM, 39 nM, 57 nM, and 61 nM, respectively), and moderate affinity for the serotonin reuptake site (Ki=98 nM) [8].

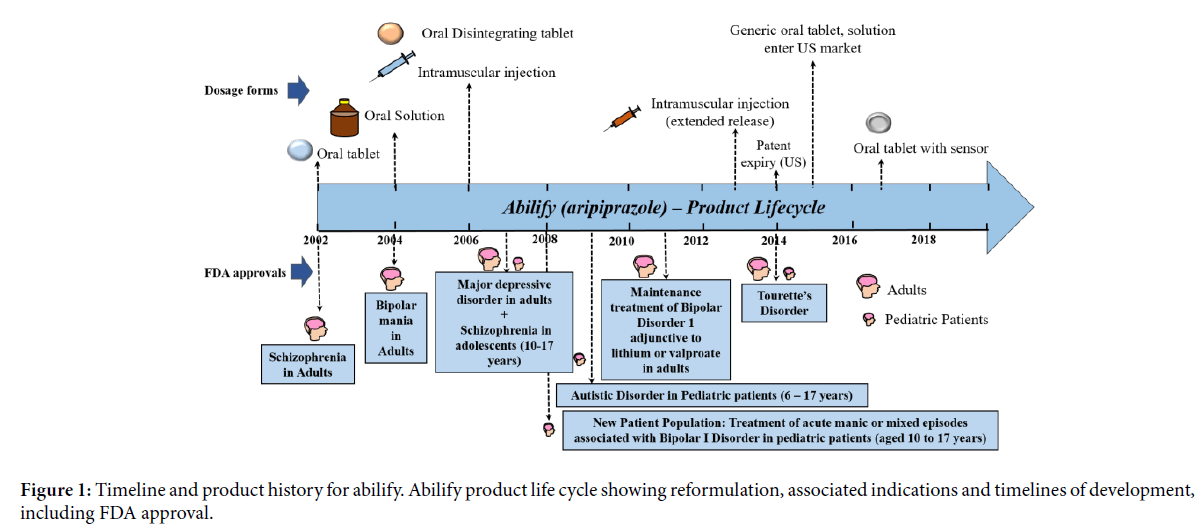

Abilify was first approved by USFDA in 2002 for the treatment of schizophrenia in adults (Figure 1). At the time of its approval, it was proposed that the efficacy of aripiprazole is mediated through a combined effect of partial agonist activity for D2 and 5-HT1A receptors and antagonist activity against 5-HT2A receptors. Up till 2004, the only formulation of Abilify available was oral tablet, which was available in different strengths and the recommended dose ranging from 10-15 mg once daily for prevention of schizophrenia in adults [9].

Figure 1: Timeline and product history for abilify. Abilify product life cycle showing reformulation, associated indications and timelines of development, including FDA approval.

In the year 2004, a new formulation of oral solution called Abilify oral solution (strength-1 mg/ml) with improved plasma concentration and bioavailability (as compared to tablet form) was approved by USFDA, for the treatment of schizophrenia and bipolar mania [10]. At equivalent doses, the plasma concentrations of aripiprazole from the solution were higher than that from the tablet formulation. In a relative bioavailability study comparing the pharmacokinetics of 30 mg aripiprazole as the oral solution to 30 mg aripiprazole tablets in healthy subjects, the solution to tablet ratios of geometric mean Cmax and AUC values were 122% and 114%, respectively. By 2005, the label was expanded to include prevention of bipolar mania and mixed episodes of bipolar disorder in adult population [11].

Abilify intramuscular injection was approved in 2006 as the first ready to use single dose vial of atypical antipsychotic for controlling agitation in adult population with schizophrenia and bipolar mania [12]. Pharmacokinetic profile comparison between the tablet and intramuscular injection was insightful. Cmax and AUC achieved for intramuscular injection was higher for the same administered dose of the tablet. A 5-mg intramuscular injection of aripiprazole had an absolute bioavailability of 100%. The Cmax achieved after an intramuscular dose was on average 19% higher than the Cmax of the oral tablet. The systemic exposure over 24 hours was generally similar between aripiprazole intramuscular injection and oral tablet administration. However, the key difference was aripiprazole AUC in the first 2 hours after an intramuscular injection was 90% greater than the AUC after the same dose as a tablet. These differences are potential making a case for the use of intramuscular injection in controlling agitation in patients with schizophrenia and bipolar mania with immediate need.

The year 2007 saw another new indication and new patient population added to the label for the treatment for major depressive disorder in adults and the treatment of schizophrenia in adolescent patients aged between 10-17 years, respectively. Subsequently in 2008 and 2009, a new pediatric exclusivity was added to the label for treating acute manic and mixed episodes of bipolar disorder in pediatric patients aged between 10-17 years and autistic disorder in pediatric patients aged between 6-17 years. In February 2011, Otsuka and BMS gained USFDA approval for Abilify as an adjunct to mood stabilizers lithium or valproate in adults with bipolar disorders. The companies were also able to demonstrate that once monthly extended release Abilify intramuscular injection was equivalent to daily dosing and gained exclusivity for new formulation in 2013 for schizophrenia and maintenance therapy for Bipolar I disorder [13]. Table 1 shows the formulation products of Abilify and the specific indications for which they have been approved by the USFDA. Abilify was approved for the treatment of Tourette’s disorder in 2014. In 2017, Otsuka got USFDA approval for drug-device delivery of the aripiprazole tablet with an embedded ingestible event marker (IEM) sensor that detects the signal after ingestion and transmits the data to the smartphone [14].

| Indication | Oral tablet | Oral solution | Oral disintegrating tablet | Oral tablet with sensor | Intra-muscular injection | Intra-muscular injection (extended release) |

|---|---|---|---|---|---|---|

| Schizophrenia (adults) | Yes | Yes | Yes | Yes | No | Yes |

| Bipolar mania: Monotherapy (adults) | Yes | Yes | Yes | Yes | No | No |

| Major depressive disorder: Adjunct to antidepressants (adults) | Yes | Yes | Yes | Yes | No | No |

| Schizophrenia (adolescents) | Yes | Yes | Yes | No | No | No |

| Bipolar mania: Monotherapy or adjunct to lithium or valproate (pediatrics) | Yes | Yes | Yes | No | No | No |

| Irritability associated with autistic disorder (pediatrics) | Yes | Yes | Yes | No | No | No |

| Bipolar mania: Maintenance treatment adjunct to lithium or valproate (adults) | Yes | Yes | Yes | Yes | No | No |

| Tourette’s disorder | Yes | Yes | Yes | No | No | No |

| Agitation associated with schizophrenia or bipolar mania (adults) | No | No | No | No | Yes | No |

| Bipolar I disorder: Maintenance monotherapy (adults) | No | No | No | No | No | Yes |

Note: Yes denotes FDA Approved, No denotes not approved.

Table 1: FDA approvals for the formulation products of abilify and the respective approved indications.

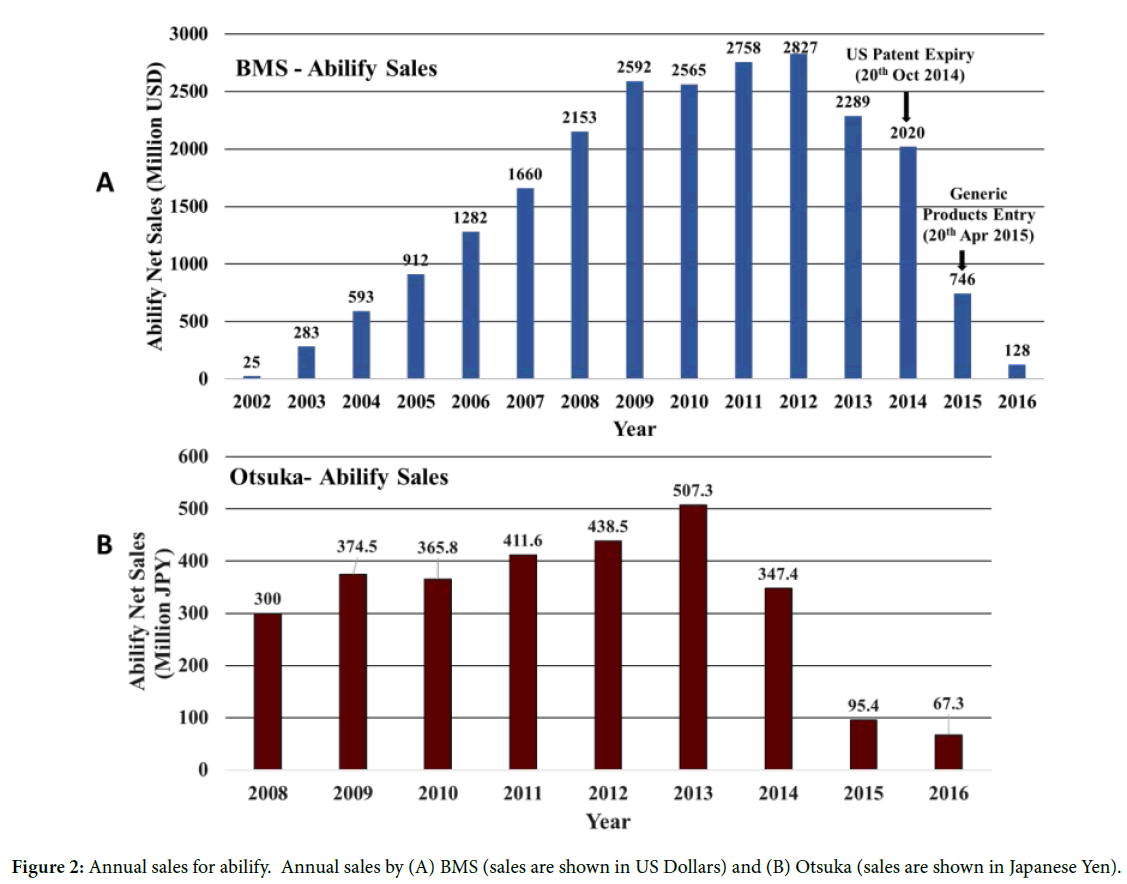

Figures 2A and 2B show the statistics on the net sales of Abilify in US market from BMS between 2002-2016 and Otsuka between 2008-2016. The net sales of Abilify increased for BMS (Figure 2A) from US ~ $25 million to ~$2.5 billion between 2002 to 2009 and highest sales figure reached in US was ~$2.8 billion in 2012 (similar trend was observed for Otsuka (Figure 2B). The increase in the net sales for Abilify was associated with new formulation products, and routes of administration which expanded the therapeutic use to new indications. The new formulations introduced had better plasma concentrations and improved bioavailability with increased overall tolerability for patients when compared to the initial oral tablet form. Exclusive commercial rights of Abilify expired for BMS in US and EU markets in the year 2014 and for Otsuka Japan market in the year 2016, and allowing generic products entry in US markets which led to a ~ 75% drop in net sales from 2015 for both BMS and Otsuka [15].

Figure 2: Annual sales for abilify. Annual sales by (A) BMS (sales are shown in US Dollars) and (B) Otsuka (sales are shown in Japanese Yen).

Reformulation success story for vimpat (lacosamide)

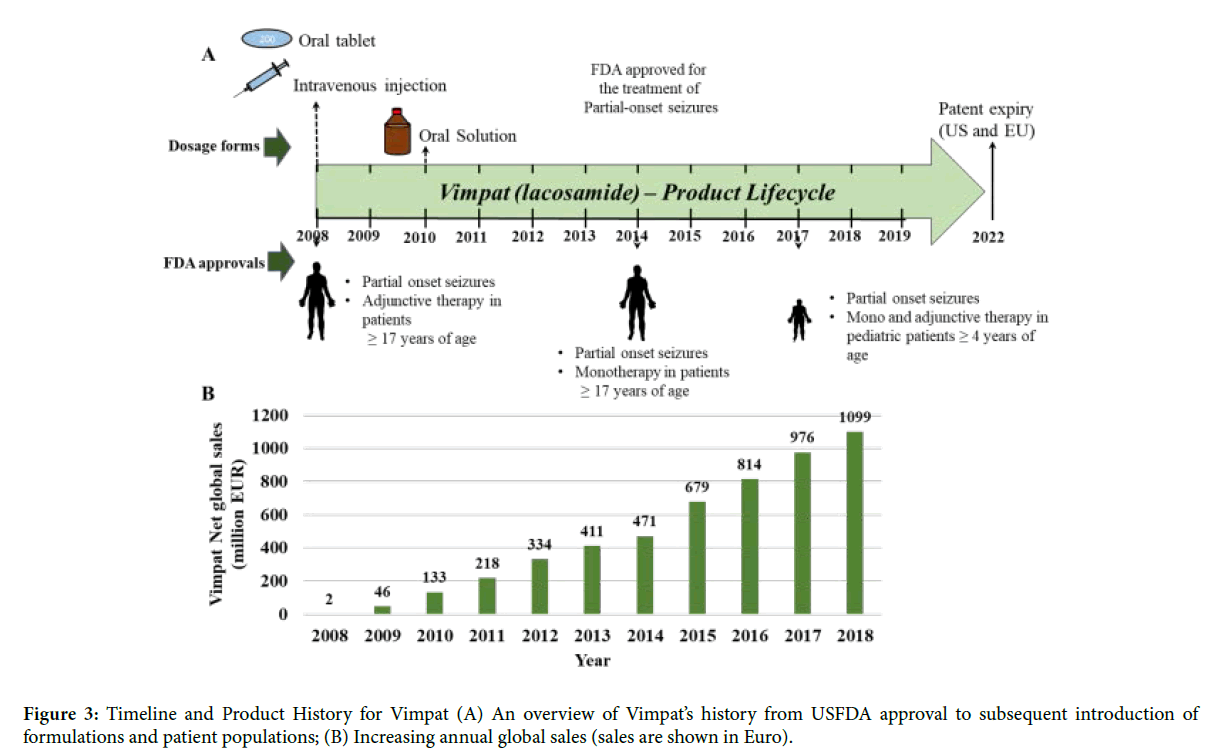

Vimpat is the trade name for UCB’s anti-epileptic drug lacosamide. Lacosamide is a blocker of voltage gated sodium channels. It selectively inhibits inactivated voltage gated sodium channels without affecting the resting voltage gated sodium channels. The IC50 value of lacosamide for inactivated Nav1.3 and Nav1.7 sodium channels is 415 and 182 μM respectively [16]. Vimpat gained USFDA approval in 2008 as an adjunctive therapy for partial-onset seizures in patient’s ≥ 17 years of age. The most common adverse events associated with the use of Vimpat are diplopia, nausea and headache. Lacosamide was initially launched in two formulations, as film-coated oral tablets with different strengths and as an intravenous injection for temporary use in cases where a requirement for acute administration exists, but oral administration was not feasible (Figure 3) [17,18]. The bioavailability and tolerability of the oral and intravenous formulations are comparable for Vimpat. Hence, Vimpat provides an advantage since the oral and intravenous dosage forms can be switched according to the need without any dose adjustments [19].

Figure 3: Timeline and Product History for Vimpat (A) An overview of Vimpat’s history from USFDA approval to subsequent introduction of formulations and patient populations; (B) Increasing annual global sales (sales are shown in Euro).

Within first year of approval and launch in the US and EU, Vimpat posted an annual revenue of ~46 million euros [20]. In 2010, a new dosage form of an oral solution was introduced in the US. The oral solution has been shown to be bioequivalent with the tablet form [21]. In the following years Vimpat was also introduced into newer markets [22]. Its global reach increased from being sold in 22 countries in 2010 to 38 countries by 2013.

With clinical trials elucidating that lacosamide was effective as monotherapy in the treatment of partial onset seizures in patients who were on multiple anti-epileptic drugs [23], Vimpat was granted USFDA approval for use as monotherapy for partialonset seizures in patient’s ≥ 17 years of age in 2014. By 2015, aided by further geographical expansion of its markets as well as its approval as the main or supporting therapy for epilepsy, Vimpat’s global revenue crossed the 0.5 billion euros mark [22]. Vimpat achieved another landmark in 2017, when the oral dosage forms gained USFDA approval as monotherapy and adjunctive therapy for the treatment of partial-onset seizures in paediatric patients of ≥ 4 years of age. A positive attribute of Vimpat is that the adverse events seen in adjunctive therapy in adults are not exacerbated on use as monotherapy or following use in paediatric patients [20]. This has undoubtedly helped Vimpat gain approval from users as well as health care providers. Apart from major markets, namely US and EU, Vimpat’s revenue from rest of the world also expanded gradually coinciding with approvals in Japan and China. In Japan Vimpat was approved as an adjunctive therapy (2016) and monotherapy (2017) for the treatment of partial-onset seizures; and in China it was only approved as an adjunctive therapy for the treatment of partial-onset seizures (2018). In 2018, Vimpat attained the blockbuster drug status with global revenue of ~1.099 billion euros.

Reformulation is one of the most prevalent LCM strategies. When used optimally, reformulation with or without change in ROA allows repositioning a drug to a new indication or a new patient segment. In addition, reformulation is used to address a treatment strategy for a niche patient population. These benefits are clearly visible from the two case studies discussed in this paper.

In case of the antipsychotic drug Abilify (aripiprazole), a sustained increase in net sales was seen every year in the first decade since its launch in 2002. This time period also saw the introduction of three dosage forms, i.e., oral solution, oral disintegrating tablet and intramuscular injection. One among these has a newer ROA. Abilify was originally launched as an oral tablet in schizophrenia in adults. Along with new formulations of aripiprazole, this time period also saw an expansion of the drug’s indication to bipolar disorder, bipolar mania, schizophrenia in adolescent patient segment and patient populations. Change in ROA to intramuscular expanded utility in schizophrenia and bipolar mania patients who suffer agitation. An extended release aripiprazole intramuscular injection is used as a maintenance therapy in bipolar disorder. Unsurprisingly, a bulk of Abilify’s total lifetime revenue was earned in its first decade following launch. The introduction of two formulations of Abilify late in its life cycle: the extended release intramuscular injection launched in 2013 before the expiry of the US patent in 2014 and the oral tablet with sensor in 2017, suggest that reformulation is a strategy that drug companies might employ for extending the life cycle and earning revenue despite loss of exclusivity and the entry of generics. Abilify is a case where one could clearly visualize the complete life cycle of the drug, and how different reformulations strategies were adopted by the companies in coherence with expansion of indication and patient population resulting in the commercial success of this drug.

In case of the anti-epileptic drug Vimpat, apart from the oral tablet formulation, the simultaneous launch of intravenous infusion injection in 2008 enabled the drug to be utilized by patients for whom oral administration was not feasible (as might occur in the case of partial-onset seizures). The subsequent introduction of the oral solution in 2010 also provided a pediatric patient-friendly option for oral administration. The manufacturer’s decision to provide patients with multiple dosage options has undoubtedly contributed to the increasing yearly sales of Vimpat since its launch in 2008. As compared to Abilify, Vimpat has not reached the patent cliff yet. Going ahead, it would be interesting to see how UCB deals with the impending patent expiry of lacosamide in US and EU in 2022 and loss of exclusivity in Japan in 2024.

To summarize, reformulation is a key line extension strategy in providing clinical and commercial benefit during drug life cycle.

Authors are grateful to Debasis Pore and Krishna Madhuri Manda for help with the curation of the FDA approved drugs

S.S.J., S.A. and T.J. curated and compiled the data; K.C.V., R.S.N., S.S.J., S.A, and T.J. analyzed the data; K.C.V., R.S.N. and S.K.S. wrote the article; S.S.J. and S.K.S. reviewed the article; S.K.S., and N.G. conceived the original idea and supervised the project.

The authors declare that there are no financial or non-financial conflicts of interests related to this publication.

Received: 26-Feb-2020

Copyright: © 2020 Venneti KC, et al. This is an open access paper distributed under the Creative Commons Attribution License. Journal of Biology and Today's World is published by Lexis Publisher.